Budget 2023 Summary

The Budget’s focus was around delivering on the Government’s key commitments to halve inflation and increase energy security. The Chancellor also committed to continuing the Government’s support for households struggling with the cost of living crisis. Below is a summary of some of the most relevant announcements for the energy efficiency industry and the wider net zero sector.

Energy Bills

- The Government is maintaining the Energy Price Guarantee at £2,500 for the typical household for a further 3 months until July 2023. This is expected to save households an average of £160 on their energy bills.

- It is also aligning charges for direct debit and Pre-Payment Meter (PPM) customers to ensure that the more than 4 million households on PPMs no longer pay a premium for their energy costs.

Call for Evidence – VAT Energy Saving Materials Relief

In the Budget 2022, the Government announced plans to expand the VAT energy saving materials (ESM) relief in Great Britain, providing tax incentives worth approximately £280 million to improve the energy efficiency of homes over a five-year period to 31 March 2027.

They have released a call for evidence seeking views on two further potential areas of reform to make the VAT relief more effective.

- The first area concerns the inclusion of additional technologies. o Other than wind and water turbines, the list of qualifying materials has remained the same since 2006, so the Government is assessing whether it is up to date.

- The main potential reform is a proposal to include electrical battery storage within the VAT relief for ESMs.

- The second area proposes extending VAT relief to ESMs installed in charitable buildings. At the moment, the relief only applies to domestic and residential accommodation.

Once enacted, the Windsor Framework will mean that VAT relief for the installation of energy saving materials (ESMs) in residential accommodation is expanded to Northern Ireland. This means that VAT relief will apply in Northern Ireland as it currently functions in Great Britain.

The call for evidence closes on 31 May 2023.

Consultation – Climate Change Agreement Scheme

The Government is extending the Climate Change Agreement scheme by two years, meaning that participants who meet agreed energy efficiency targets will be entitled to reduced rates of Climate Change Levy in 2025-26 and 2026-27. The support offered over the course of the two-year extension is expected to be worth approximately £600 million. The current scheme was due to finish in March 2025.

DESNZ has released a consultation seeking views on the details of the extension and proposals for any potential future Climate Change Agreement scheme.

Climate Change Levy – Changes to Rates from 1 April 2024

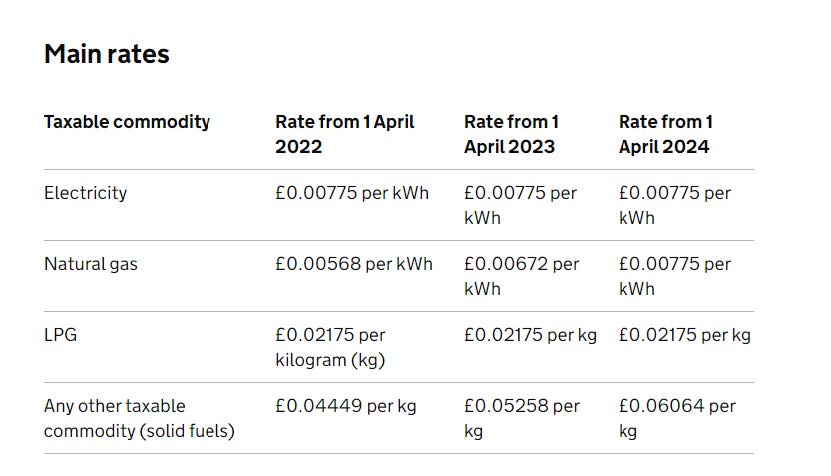

From 1 April 2024, the Government will increase the main rate of Climate Change Levy (CCL) for gas to meet the frozen electricity rate, with the main rate for solid fuels being increased proportionally to gas. The main rate on LPG will continue to be frozen in 2024-25. The measure fulfils the Government’s commitment in Budget 2016 to equalise the main rates of CCL on electricity and gas in £ per kilowatt hour (kWh) by 2025.

Please see a table below outlining the main changes to the levy.

Fuel Duty Freeze

The Government is freezing fuel duty for a further 12 months, meaning the planned 11p inflationary rise in fuel duty will not take place. This will save the typical driver £100.

Energy Profits Levy – Decarbonisation Allowance

The Government is introducing a decarbonisation allowance within the Energy Profits Levy, which will provide an 80% investment allowance rate for qualifying expenditure spent on decarbonising upstream oil and gas production.

Electric Vehicles

The Government has announced that it will extend the availability of the 100% first-year allowance for qualifying expenditure on plant and machinery for electric vehicle charge-points by two years. The extension will come into force next month (April 2023) and continue until the end of the 2024-25 financial year. The allowance aims to incentivise businesses to install charging points and purchase zero emission vehicles.

Plastic Packaging Tax

The rate of Plastic Packaging Tax will increase from 1 April 2023 in line with the Consumer Price Index (CPI).

Join our policy mailing list

NIA members are vital to help shape our consultation responses. If you would like to receive draft consultations for you to provide your input, please email info@NIA-uk.org